About 69% of tourists chose to use Alipay when abroad and WeChat Pay accounted for 46%.

This is a fascinating report on the purchasing behaviour of Chinese outbound tourists.

Payment methods

Bank cards are still very important at 77%; however, mobile payment options Alipay and WeChat are very strong. 69% of tourists chose to use Alipay when abroad and WeChat Pay accounted for 46%.

Payment tools as media providers

‘Scan the QR code and pay’ is the main function for these payment apps, but they can do more than that. The app shows more information about the neighbourhood – a bit like TripAdvisor.

You can find great restaurants, shops and coffee houses around the area. Other users can share their experiences so you can not only pay but find information around you -which can trigger consumption.

Converting to purchase

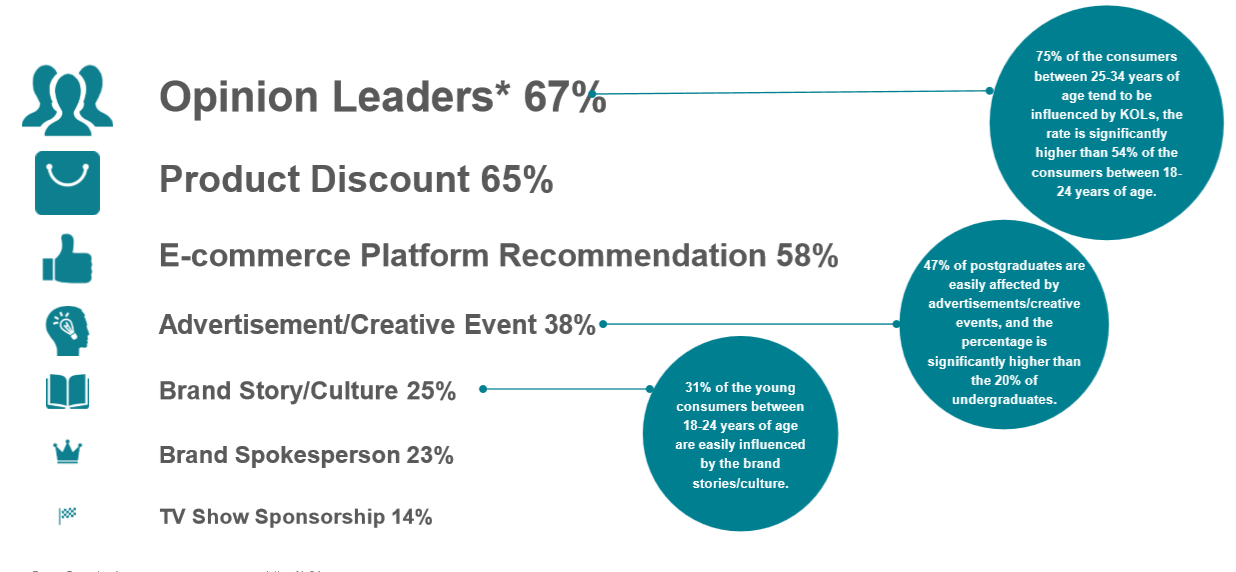

The main drivers to purchase are opinion leaders – friends, relatives, colleagues, or KOLs (Key Opinion Leaders) such as internet celebrities – who take 67% of market share.

The next is discounts at 65%, third is recommendations at 58%. This is particularly attractive for cross-border tourists and overseas residents.

Social commerce

Get your story out via Chinese social media platforms. Chinese consumers want to see real opinions and want to see how these places interact with people. Chinese people are still highly reliant on the word of mouth and the opinions of fellow Chinese tourists.

Social commerce is simply e-commerce with a social flavour. If you see a brand talking about their product on WeChat, it’s just one click to the e-commerce platform, also within WeChat. It’s useful for brand presence and popularity but also you can change them from a follower to a consumer.

Digital trends

Chinese consumers are tech savvy and are using their mobile phones all the time.

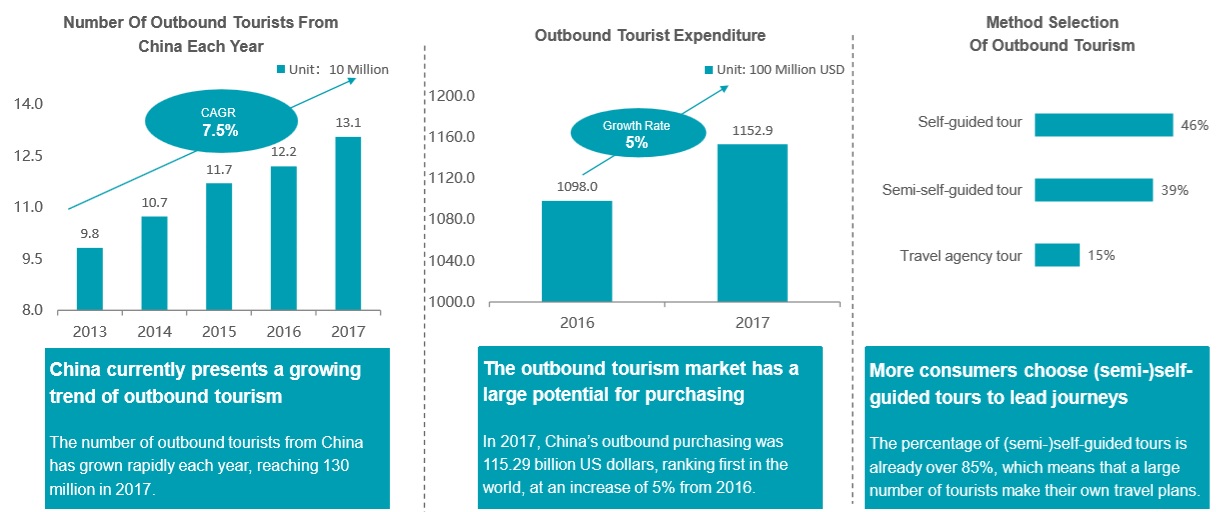

The number of outbound Chinese tourists has grown rapidly to 130 million. In 2017, China’s outbound purchasing reached USD 115 billion – the highest number in the world. That’s a 5% increase from 2016.

Travel type

85% of the outbound traveller volume is self-guided or semi self-guided. Only 15% is being reported as guided or managed tours.

These days, Chinese tourists are younger and more educated so the language barrier has gone.