Chinese tourists spent an average of $762 per person towards shopping on overseas trips, and they primarily use mobile payments for shopping, dining and visits to tourist attractions.

The Outbound Chinese Tourism and Consumption Trends: 2017 Survey, jointly issued by Nielsen and Alipay, provides an in-depth analysis of current consumption and payment behaviors of outbound Chinese tourists travelling overseas and assesses future trends.

According to statistics from the China National Tourism Administration, Chinese tourists traveled overseas on 131 million occasions in 2017, an increase of 7.0% from the previous year. Data from the International Association of Tour Managers shows that overseas travel spending by Chinese tourists reached USD 261.1 billion in 2016, an increase of 4.5% year-on-year, and ranking first worldwide.

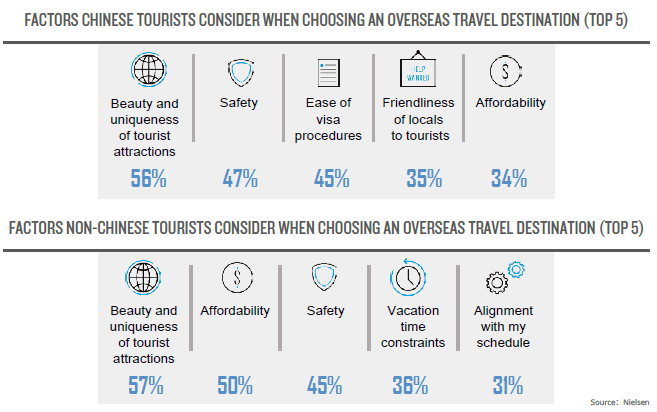

"Cost" far less important than “experience”

For Chinese tourists who are generally well-off, tourist attractions and the travel experience are more important factors than the costs that might be incurred. 56% of the respondents expressed that the beauty and uniqueness of a given destination is their primary consideration, while 47% stated that safety of the destination would affect their travel choice. 45% said that they would consider the ease of visa procedures, and 35% felt that it is important that the locals at the destination make them feel welcomed. The question of affordability is only the fifth highest priority, with 34% of respondents expressing concern for the costs.

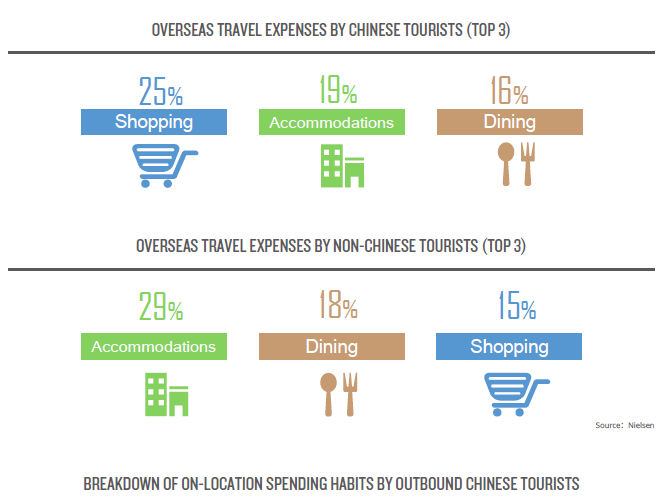

Chinese tourists exhibiting stronger purchasing power

The top three categories of expenses by outbound Chinese tourists are shopping (25%), hotel accommodations (19%), and dining (16%). Other categories of expenses include visits to tourist attractions, local transportation, recreation, and communications and others. Non-Chinese tourists spend the highest proportion of their travel funds on hotel accommodations (29%), dining (18%), and shopping (15%) during overseas trips. Non-Chinese tourists are more frugal in general, but will spend a greater proportion of their travel budget towards accommodations.

Chinese tourists spent an average of USD 762 per person towards shopping on their most recent overseas trip, while non-Chinese tourists averaged USD 486.

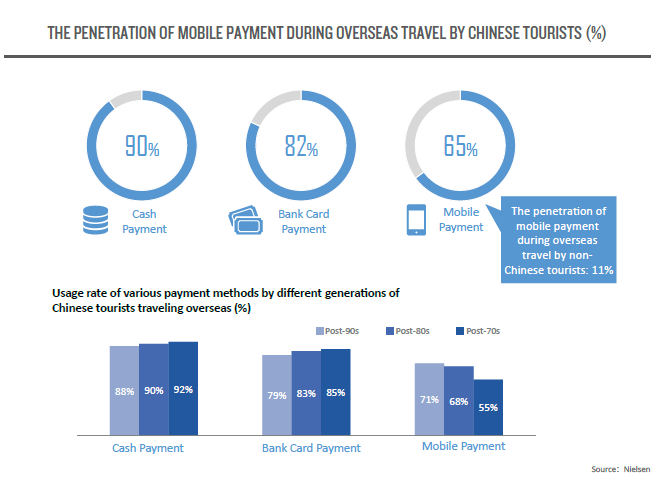

65% Chinese tourists used mobile payment during overseas travel

According to the survey, the proportion of Chinese tourists who use mobile payment platforms is far greater than that of non-Chinese tourists. During their most recent overseas trip, 65% of Chinese tourists paid for their expenses via mobile payment, while a mere 11% of their non-Chinese counterparts used mobile payment.

At present, the proportion of Chinese tourists using mobile payment (28%) is quickly approaching that of cash payments (30%). Compared with the previous two years, the proportion of cash payment has declined while the use of mobile payments has increased. Total transaction volume via mobile payments has also been on the rise: 77% of Chinese tourists spent more via mobile payments on their most recent overseas trip than on previous trips over the past two years.

Chinese tourists primarily use mobile payments for shopping, dining and tourist attractions

Shopping is where Chinese tourists use mobile payments the most. 63% of the Chinese respondents said they have used mobile payments for shopping, and 76% hoped that they could use mobile payment for shopping during their overseas travels in the future. 62% of the Chinese respondents have used mobile payment platforms to pay for dining, and 58% to pay for visits to tourist attractions. These are the three consumption categories in which Chinese tourists most often pay by mobile payments.

Increased adoption of mobile payment encourages spending by outbound Chinese tourists

The survey shows that 93% of Chinese tourists would consider using mobile payments when traveling overseas if more overseas merchants would accept mobile payments in the future, while 91% would show greater willingness to spend and shop if overseas merchants accept Chinese mobile payment brands.