There are 8 key findings on Chinese luxury travelers.

Hurun Report and International Luxury Travel Market Asia (ILTM Asia) issued The Chinese Luxury Traveler 2017: 60% of outbound luxury travelers willing to spend more than 3,000 yuan for a room night and travel business class or first class, adventure travel is the theme of choice for the three years, beach holidays on the rise, becoming a travel theme last year and luxury travel agencies flourish.

Customized travel services have begun to spread, with more than half of high-end travelers said they have experienced it.

Eight Key Findings

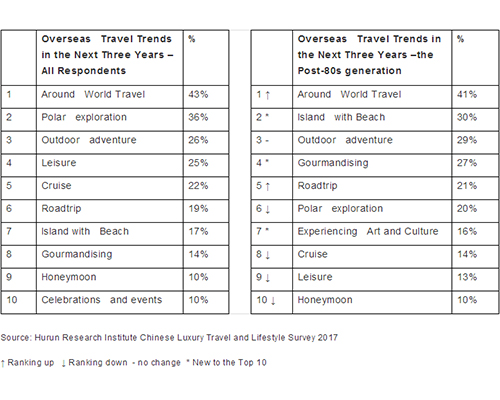

1. Travelers prefer adventure tourism, it will be the luxury travel trend in the next three years.

Around World Travel, polar exploration, and outdoor adventures are themes for the Chinese luxury traveler in the next three years. Compared to the dominance of traveling for leisure in the past few years, this year, there is a marked increase in the Chinese luxury travelling for adventure. It should be noted that the Post-80s generation has displayed an increased interest in Africa and the Polar Regions, with numbers rising from 23% and 17% last year to 36% and 32% respectively this year.

2. The seasons significantly influence traveler’s choice of destination.

The time of year has a large bearing on the choice of location. In summer and autumn, the Post-80s luxury travelers possess a marked preference for island-hopping, with Phuket (27%), Maldives (18%) and Fiji (16%) and China's Sanya (16%) are the most popular choices. In winter and spring, Australia (16%) and Phuket (18%) are popular among sun-worshippers, while ski enthusiasts flock to Japan (32%), Canada (8%) and Switzerland (7%) also are traveler’s most likely destination.

3. Island with Beach was the dark horse of vacation themes last year.

Although Leisure at 41% was still the most popular vacation theme, polar exploration and outdoor adventures have continued their momentum from the past two years and rank second (31%) and fourth (20%) respectively. As a new option in this year’s study, island holidays were the dark horse of vacation themes and surpass both cruises (13%) and self-drive holidays (14%) and other traditional modes of travel to rank third. Island holidays are especially popular among the Post-80s generation and rank first with almost fifty percent (46%).

4. Europe and Southeast Asia are the outbound destination of choice.

Last year, Europe and Southeast Asia have grown in popularity as a destination accounting for 45% and 44% of respondents respectively. In just two years, Southeast Asia has successfully surpassed the Americas become the Chinese luxury traveler’s new choice, displaying a shocking 34% increase in millennial favour and jumping from last year’s fourth place to take the crown this year. Rupert Hoogewerf, Hurun Report Chairman and Chief Researcher said: “In the past years, Chinese luxury travelers have gone abroad an average of 3.3 times and stayed for an average of 27 days, with tourism increasing 5% to reach 69%”.

5. Hotels.

1) Luxury hotels are still the first choice for China's luxury travelers. The Ritz-Carlton and Four Seasons hotels are the most popular choices, ranking first and third. Boutique hotels are increasingly favoured, with Banyan Tree jumping from sixth place last year to fourth place this year, while Aman entered the top ten in seventh place. Hilton wins the “Most Popular Luxury Business Hotel” title, with Shangri-La, Sheraton, and top ten newcomer Marriott following closely after. The hotel of the most luxury traveller members is also The Ritz-Carlton, with the popularity of the brand experiencing a 19% increase over the last two years, taking the crown from Hilton. In the same two years however, Marriott drop from second to sixth. Rupert Hoogewerf said, “Compared to airline memberships, hotel memberships do not hold as much value”.

2) At 81%, resorts are overwhelmingly popular among luxury travelers and are their favourite type of luxury accommodation. Business hotels (18%), bed and breakfasts (9%), and apartment hotels (6%) are also preferred, but by a much smaller margin of travelers.

3) 60% outbound luxury travelers spend more than 3,000 yuan per night. 32% of luxury travelers have accommodation budgets of over 5,000RMB per night. Humanized Service is the most important consideration, followed by a good view of the room.

4) At 56%,

local cuisine is the most popular hotel restaurant cuisine option for Chinese luxury travelers. Japanese and Cantonese cuisine follow after by 32% and 31% respectively. French cuisine,

Italian cuisine and Sichuan cuisine are all topped the list ten, while the Korean cuisine and hot pot did not in top ten.

5) Private dining room is receiving more attention as venues for private banquets and business dinners.

6) Accommodation sharing is still in its early stages in the luxury market. Private home-stay options like Airbnb are selected by only 25% of respondents, trailing behind the boutique hotel (48%) and the cruise (45%). 69% of respondents remain neutral or will not explore home-stay in the next three years.

6. China's luxury travelers are placing a higher premium on comfort when they travel.

61% of respondents, on their most memorable trips, travelled in business or first class. Air China has the most popular membership scheme among domestic airlines (54%), with China Southern Airlines (22.4%) and Cathay Pacific (21.9%) coming in after. Among foreign airlines, Emirates and Singapore Airlines both run ahead of the pack at 23% and 22% respectively, benefiting from their reputations for offering both cost-effective and high level services. The fact that Singapore and Dubai airports are such important hubs for flight transfers also contribute to their popularity.

7. Customized travel services start to spread, with agencies placing a strong emphasis on the quality of travel itineraries to retain customers.

More than half of luxury travelers (58%) said that they have experienced customized travel services. They are partial to travel agencies that provide well-designed itineraries, personalized services, and are actively problem-solving, placing 59%, 55%, and 49% of emphasis on each aspect respectively. The emphasis placed on problem-solving ability of travel agencies has experienced an 11% increase in two years.

Agencies in “Hurun Mainland China Outbound Luxury Travel Agencies 2017 Top 12” ranking include 8 Continents, Diadema, D-Lux Travel*, CITS Amex, HHtravel, My Tour, Magic Travel, Ctrip, Zanadu, CITS, CTS, and CYTS. Agencies in the “Hurun Hong Kong Outbound Luxury Travel Agencies 2017 Top 6” include Wincastle Travel Limited, Cathay Pacific Holidays, Charlotte Travel*, American Express, Swire Travel, and Westminster. Agencies in the “Hurun Taiwan Outbound Luxury Travel Agencies 2017 Top 6” include One Style Tour*, Seascape Escape, Let’s Travel*, American Express, International Travel Information Services, and Lion Travel. (In alphabetical order, *new to list).

8. Travel retail.

While on holiday, Chinese luxury travelers like to purchase cosmetics (45%), local produce (43%), bags and suitcases (39%), clothes and accessories (37%), and jewellery (34%). Other than local produce, the four other most popular purchase categories are all dominated by female consumers. Compared to numbers two years ago, there is a noticeable increase in the percentage of travelers who bought cosmetics. With regard to the purpose of the purchase, 76% of purchases are personal, while 47% of purchases are gifts, and 4% are purchased on the behalf of others.