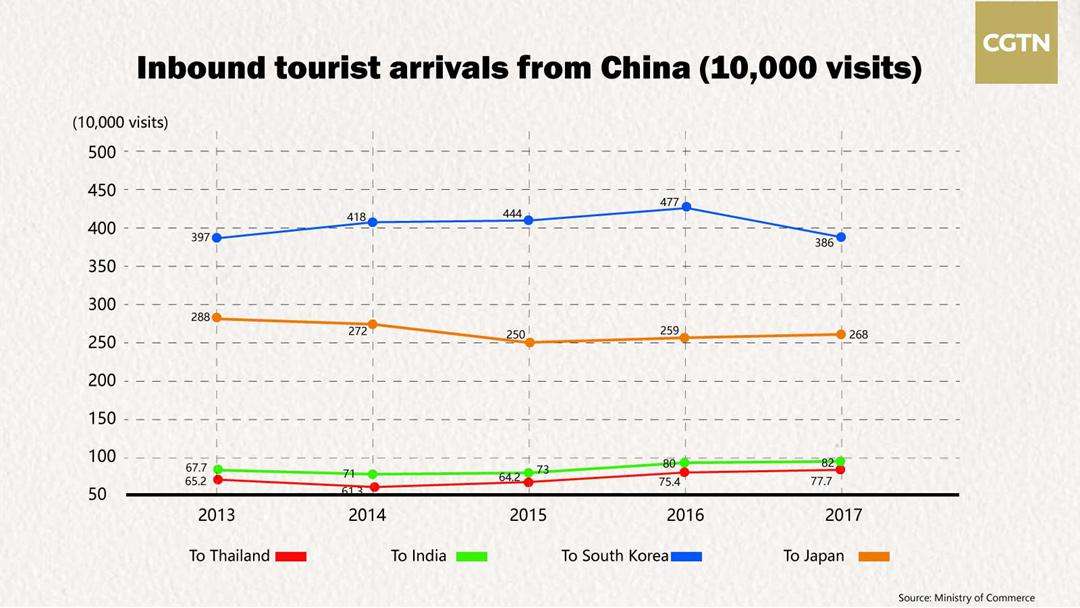

Recent years have witnessed a surge in Chinese tourists bound for neighboring Asian countries, such as Japan, South Korea, Thailand, Indonesia and India, thanks to growing disposable income and the relatively short distance between China and these destinations.

According to the Global Tourism Economy Trend Report, Europe, the Americas and Asia-Pacific are the top three regions in the global tourism landscape and hold the world's top 10 tourist destinations. However, the proportion of travel to Europe and the Americas has slipped as the Asia-Pacific region has climbed. Between 2005 and 2016, total visits to Europe fell from 25.6 percent to 16.3 percent and visits to the Americas fell from 27.3 percent to 17.7 percent. However, visits to the Asia-Pacific region rose to 63 percent from 43.5 percent.

Visas are becoming more accessible

Different countries have rolled out new visa initiatives to attract more tourists and enhance tourism competitiveness. Visa-free entry has become normal in countries with strong tourism industries. However, many countries have facilitated visa procedures by adding visa officers, increasing visa quotas, lowering visa application thresholds, extending visa validity and implementing e-visas.

Many Asian countries have removed visa requirements for Chinese citizens, including Indonesia, Qatar and

the UAE.

During the period of 2011-2016, tourism transaction and medium-sized M&A transaction volume in the Asia-Pacific region accounted for 5 percent; in the medium-sized M&A transactions in Southeast Asia, tourism M&A transactions accounted for 6.9 percent, and the transaction volume accounted for 6.3 percent; in Japan, the ratio is 6.6 percent and 5.4 percent respectively; the ratio for both is 3.3 percent in China (including Chinese mainland, Hong Kong, Macao, Taiwan).

Frequent cross-border M&A is integrating and changing the international tourism industry, and promoting the internationalization and industrialization of the industry.