Chinese international travellers, swelled by a wave of individualistic millennials joining the middle class, are likely to be spending more on their trips overseas by 2025 than their counterparts from Germany, the UK and France combined

Chinese international travellers, swelled by a wave of individualistic millennials joining the middle class, are likely to be spending more on their trips overseas by 2025 than their counterparts from Germany, the UK and France combined, a report has found.

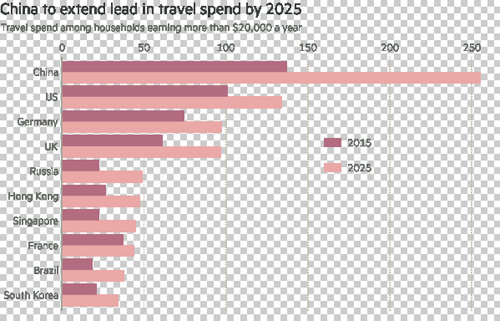

The rise to such dominance over the international travel market will expand revenues from Chinese travellers in 2025 to a total of $255.4bn, up 86 per cent from $137bn last year (see chart), according to research by Oxford Economics, a consultancy, and Visa, the payments company.

If such projections materialise, China’s outbound travel market will be almost twice as large in 2025 as that of the US, which is likely to generate $134bn in traveller spending in 2025, up from an actual $101bn last year, according to the report.

Wayne Best, chief economist at Visa Inc, said that the ease of overseas travel will receive a fillip from some 340 new airports that are expected to be built over the next decade. Similarly, internet connectivity makes it easier for potential travellers to book their itineraries and check out what attractions look like before they commit to the expense. An ageing global population will also see more silver-haired travellers hitting the road.

“Travelling internationally will become more common and attainable in the future thanks to changing demographics, combined with technology advances that make travelling abroad easier and less expensive,” Mr Best said.

The report used Visa’s payments data and blended that with Oxford Economics’ macro projections to estimate 2025 spending patterns. It based its study on households that earn at least $20,000 per year, a cohort it sees as expanding to embrace half of global households — 945m — by 2025 as the middle class in China, Brazil, Russia and other emerging markets swells.

Of these 945m households, some 282m will undertake at least one trip a year in 2025, driving total spending to $1.5tn, up 35 per cent from last year. The study did not include spending on air tickets in its calculations, making the estimates lower than from some other sources.

The World Travel and Tourism Council, for instance, estimates that $215bn was spent by Chinese travellers abroad last year, a 53 per cent jump from a year earlier — considerably higher than the $137bn estimate by Visa and Oxford Economics.

As Chinese travellers intensify their dominance, so the tourism marketplace will come to further reflect their preferences. FT Confidential Research (FTCR), a unit of the Financial Times, found in a survey of preferences this year that more travellers increasingly sought individualised itineraries rather than simply traipsing from tourist trap to tourist trap.

“Our clients go to the opera in Italy, watch the Northern Lights in Scandinavia and dine at Michelin-starred restaurants in Paris,” Wang Yang, chief operating officer of an online travel agency specialising in overseas travel, was quoted by FTCR as saying.

Similarly, Chinese travellers — long famous for high-octane shopping sprees while abroad — are putting much more emphasis on buying experiences rather than goods, according to a survey of more than 1,000 tourists by FTCR. The new breed of traveller is spending more on dining out, a comfortable hotel and high-quality relaxation, the survey found.